February 18, 2005

Notes

Notes

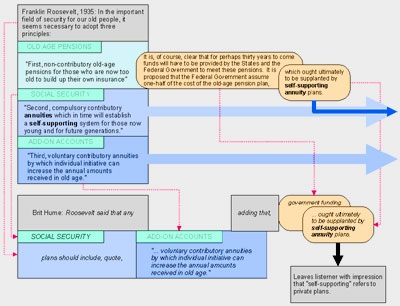

What Brit Hume Said

A few of you have written asking why I’m not featuring as many “Worthy Links.”

During the campaign, I was keeping pretty close track of sites that I thought did a good job of presenting the case in visual form. With the time I’ve been spending looking at photos, however, the links got pushed to the background. I’d like to try and keep up, though.

One of my favorite political sites for turning words into pictures is UggaBugga.

Recently, Ugga broke down an analysis made by Brit Hume suggesting that FDR would have supported private accounts. My image above is just a schematic of that diagram. To see the actual chart with comments, go here.

Reactions

Comments Powered by Disqus